Performance Bonds

What Is a Performance Bond?

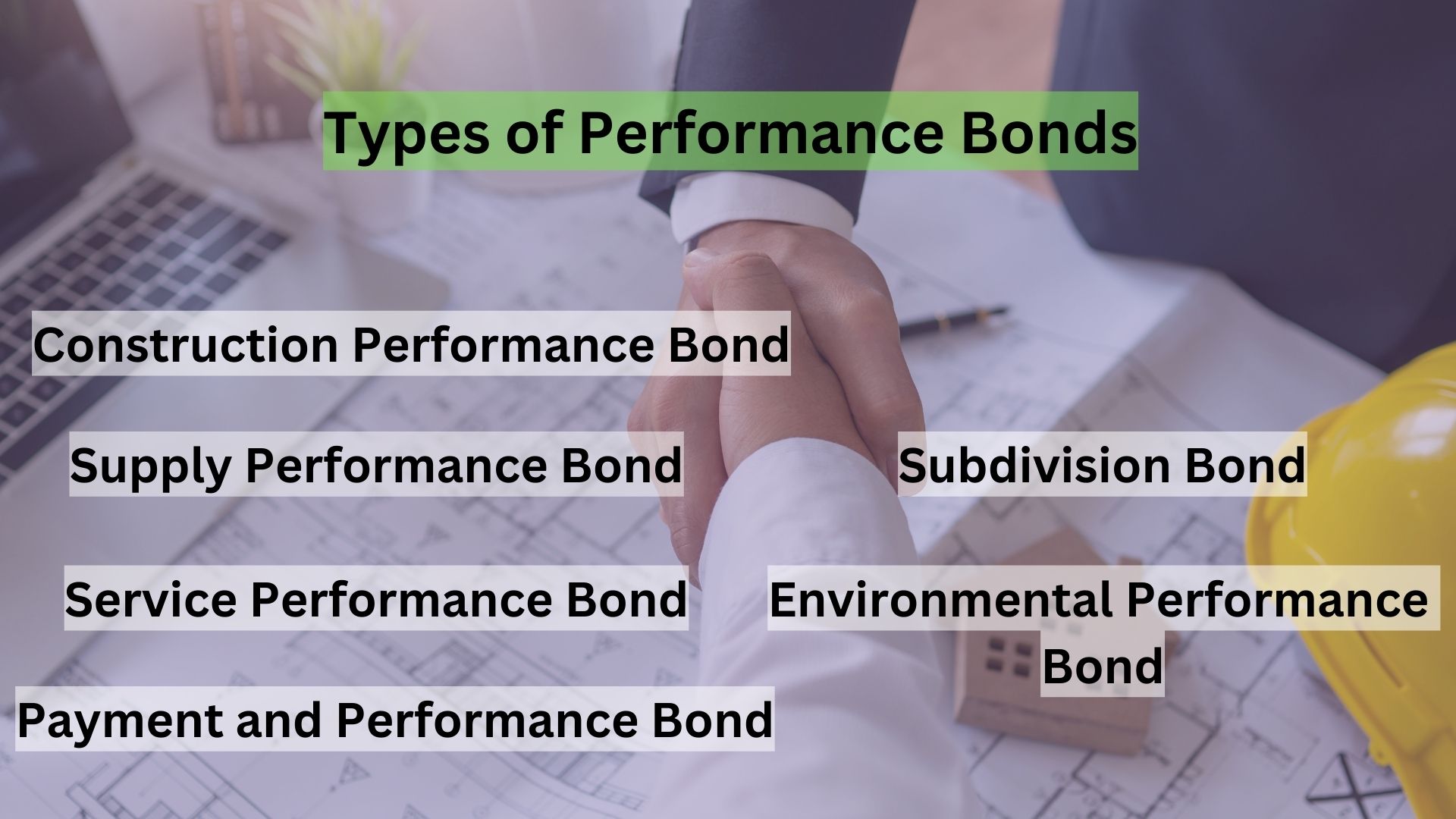

Types of Performance Bonds

Construction Performance Bond

This is the most common type of performance bond and is used in construction projects. It ensures that the contractor will perform the work as specified in the contract and within the agreed-upon time frame. If the contractor fails to meet their obligations, the bond provides financial compensation to the project owner to cover the cost of completing the work.

Supply Performance Bond

This type of performance bond is used when a contractor is responsible for providing goods or materials as part of a contract. It guarantees that the supplier will deliver the agreed-upon products or materials as per the contract terms and conditions.

Service Performance Bond

Service contracts often require this type of performance bond. It ensures that the service provider will fulfill their obligations and meet the performance standards outlined in the contract. If the service provider fails to meet these standards, the bond offers financial protection to the client.

Payment and Performance Bond

Sometimes combined into one bond, this type of bond covers both the contractor’s performance and their obligation to pay subcontractors, suppliers, and laborers involved in the project. It safeguards against non-payment issues and poor workmanship.

Subdivision Bond

Used in real estate development projects, a subdivision bond guarantees that the developer will complete the required infrastructure improvements, such as roads and utilities, in a new subdivision.

Environmental Performance Bond

This bond is specific to projects that involve environmental remediation or cleanup. It ensures that the contractor will comply with environmental regulations and complete the necessary work to address environmental concerns.

These are just a few examples of performance bonds available to meet the diverse needs of various industries and projects. Performance bonds play a vital role in providing financial security and peace of mind for project owners, ensuring that contractual obligations are met and projects are completed successfully.

What Is the Purpose of a Performance Bond?

How Does a Performance Bond Work?

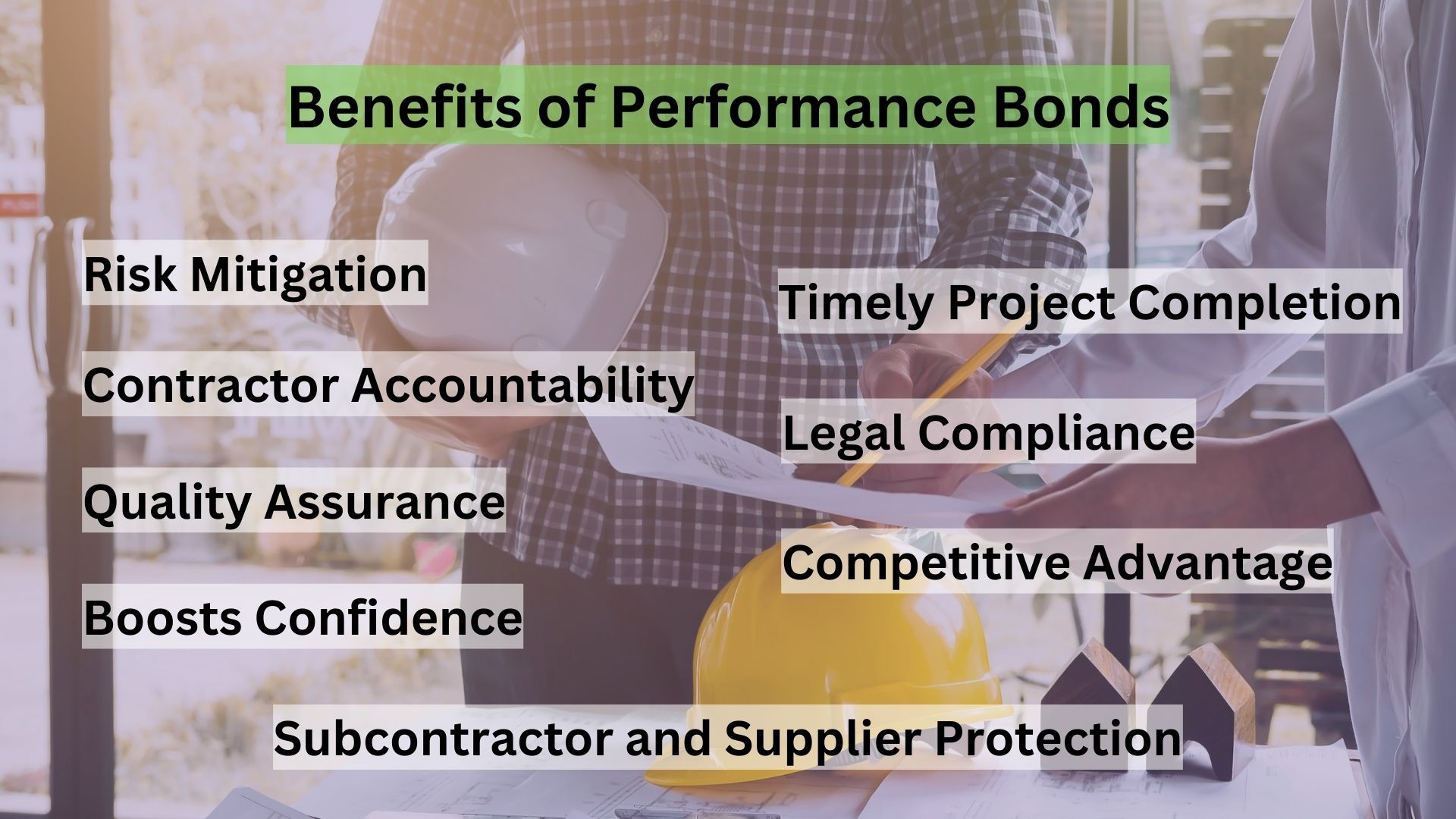

Benefits of Performance Bonds

Performance bonds offer several benefits to different parties involved in a contract or project. Some of the key advantages of having a performance bond in place include:

Risk Mitigation

Performance bonds serve as a risk management tool, protecting project owners or clients from financial losses if the contractor fails to perform their obligations as specified in the contract. In the event of non-performance, the bond provides a source of funds to complete the project or cover additional costs incurred due to the contractor’s default.

Contractor Accountability

By requiring a performance bond, project owners can hold contractors accountable for their work. Contractors are incentivized to fulfill their contractual obligations and complete the project satisfactorily to avoid potential financial liabilities associated with the bond.

Quality Assurance

Performance bonds encourage contractors to maintain high-quality work standards. To avoid bond claims and potential financial penalties, contractors are more likely to use skilled labor, quality materials, and adhere to industry standards, thereby enhancing the overall project quality.

Boosts Confidence

Having a performance bond in place instills confidence in project owners, investors, and other stakeholders. It demonstrates that the contractor is financially stable and committed to completing the project according to the agreed-upon terms.

Timely Project Completion

With a performance bond in effect, contractors are more likely to adhere to the project timeline and deliver within the specified deadline. The financial consequences of delay or non-performance motivate contractors to complete the work on time.

Subcontractor and Supplier Protection

Performance bonds often include payment protection for subcontractors, suppliers, and laborers involved in the project. This provision ensures that they will receive timely payment for their services and materials, even if the contractor defaults.

Legal Compliance

Performance bonds typically require contractors to comply with all contractual and legal obligations, including regulatory requirements. This helps ensure that the project is carried out in accordance with the relevant laws and regulations.

Competitive Advantage

Contractors who can provide a performance bond have a competitive edge in the market. It signals their financial stability and reliability, making them more attractive to potential clients and winning more contracts.

Overall, performance bonds offer a robust safety net for all parties involved in a contract or project. They create an environment of trust, reduce risks, and provide financial protection, ultimately leading to smoother and successful project outcomes.

How Much Does a Performance Bond Cost?